Resources

The global food & agriculture asset class

Growing populations—and a larger middle class—will require more food, at a time when resource constrains are becoming more acute.The food and agriculture sectors have a massive economic, social, and environmental footprint – the $5 trillion industry represents 10% of global consumer spending, 40% ofemployment, and30% of greenhouse-gas emissions. Although sizable productivity improvements over the past 50 years have enabled an abundant food supply in many parts of the world, feeding the global population has reemerged as a critical issue.

If current trends continue, by 2050, caloric demand will increase by70%, and crop demand for human consumption and animal feed will increase byat least 100%. At the same time, more resource constraints will emerge including water shortage, land degradation and the effects of climate change.

The food and agriculture value chain offers sound attributes to a diversified investment portfolio.

A growing number of investors realize that investing in the global food and agriculture value chain isoneof the largest investment opportunities ofour era. Agricultural assets provide exposure to key macro food and agriculture demand trends including population growth and increased middle-class formation in emerging markets.

In addition, agricultural real assets provide several potential portfolio benefits, including diversification, low or negative correlation to stocks and bonds, and a natural hedge against inflation.

The food and agriculture value chain

Helping you to explore the broad food and agriculture value chain

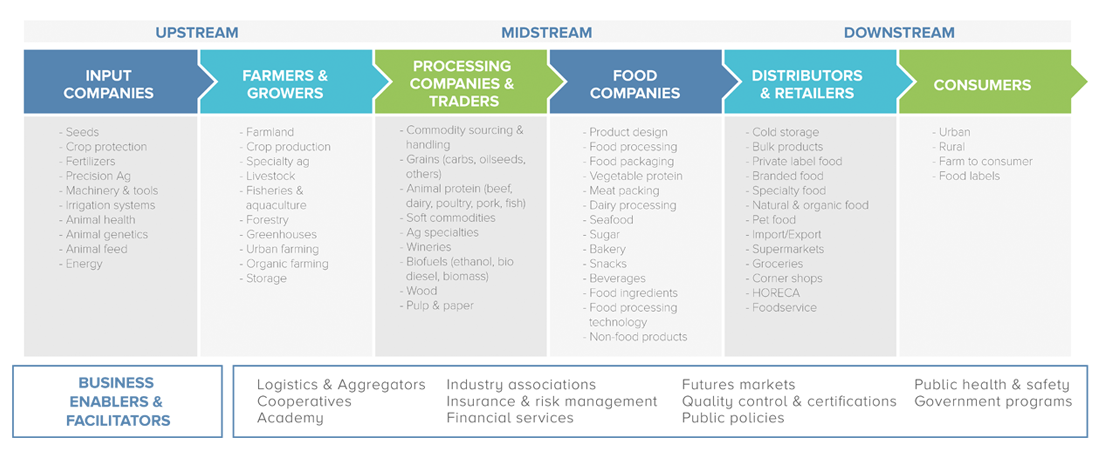

Finding the right investment opportunity isnot easy. To invest successfully in this sector requires a deep understanding ofspecific crops, geographies, and complex value chains that encompass input supply and distribution, primary production (agricultural commodities), secondary production (animal protein and other products), processing, distribution, and retail sales.

The value chain consists of multiple subsectors which, although are exposed to broadly similar macro trends, each has unique supply, demand, and competitive conditions.

Valoral Advisors is specialized and 100% focused solely on the food and agriculture value chain. We are ready tohelp you to navigate this industry and the diverse opportunities that exist within the many subsectors.

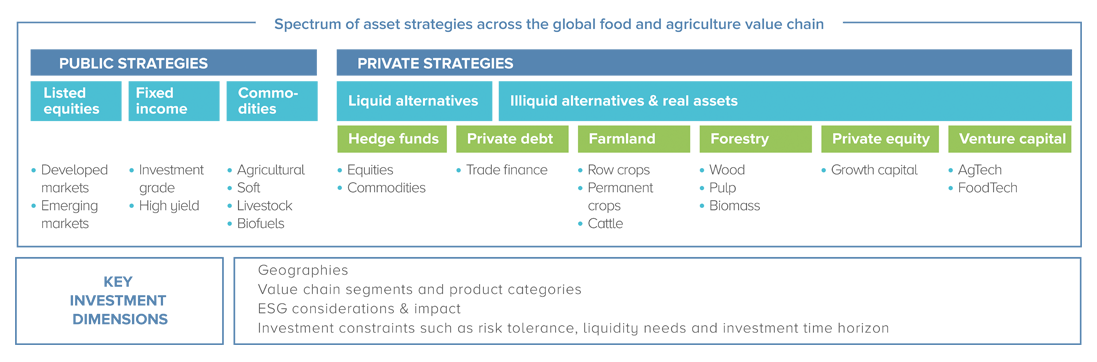

Helping you to invest confidently in the global food and agriculture asset class

Investors willing to build or expand their exposure to the global food and agriculture asset class are faced with an ever growing range of assets with different breadth of styles. We can help you to explore a broader spectrum of investment possibilities in this space, particularly among private strategies which include a wide range of assets and structures.

Media Center

Learn the latest roundup of news articles and press coverage featuring Valoral Advisors from leading financial and impact publications.